The BEST of Times…and the WORST of Times

Deciding when to invest in the stock market can be a difficult decision. This can be made even more challenging when there are headlines of looming recessions, war in Ukraine, and a pending collapse of the Australian property market.

But is timing your investment really that important?

It’s natural to want to avoid market downturns, and of course to be able to invest when it feels safe to do so. However, nobody can predict with complete precision exactly when the right time to invest is. And unfortunately, rarely does it feel safest to invest at the best time to do so. The best time to be investing often feels like the worst.

What impact would you actually find on your overall returns over time if you managed to invest at the worst possible time (market high), or at the best possible time (the bottom of the market)?

Given all of the volatility in the market at present, and the negative headlines occupying most media sources, our Investment Committee at Ally Wealth decided to analyse the answer to this question.

To illustrate the answer to this question, we’ve used two hypothetical investors, John and Jill, who both invested $10,000 each year over a 20 year period from 1999 through to 2018. Jill managed to invest her $10,000 on the lowest day on the market each year, while John managed to pick the highest day each year to invest his $10,000. The question we sought to answer was simply:

“What impact would we see between the overall returns of John and Jill over this 20 year time frame..?”

In this example, we’ll use the S&P 500, which is a barometer for larger US listed companies, which would be familiar to most Australian investors, and can easily be accessed for an ETF or index fund approach.

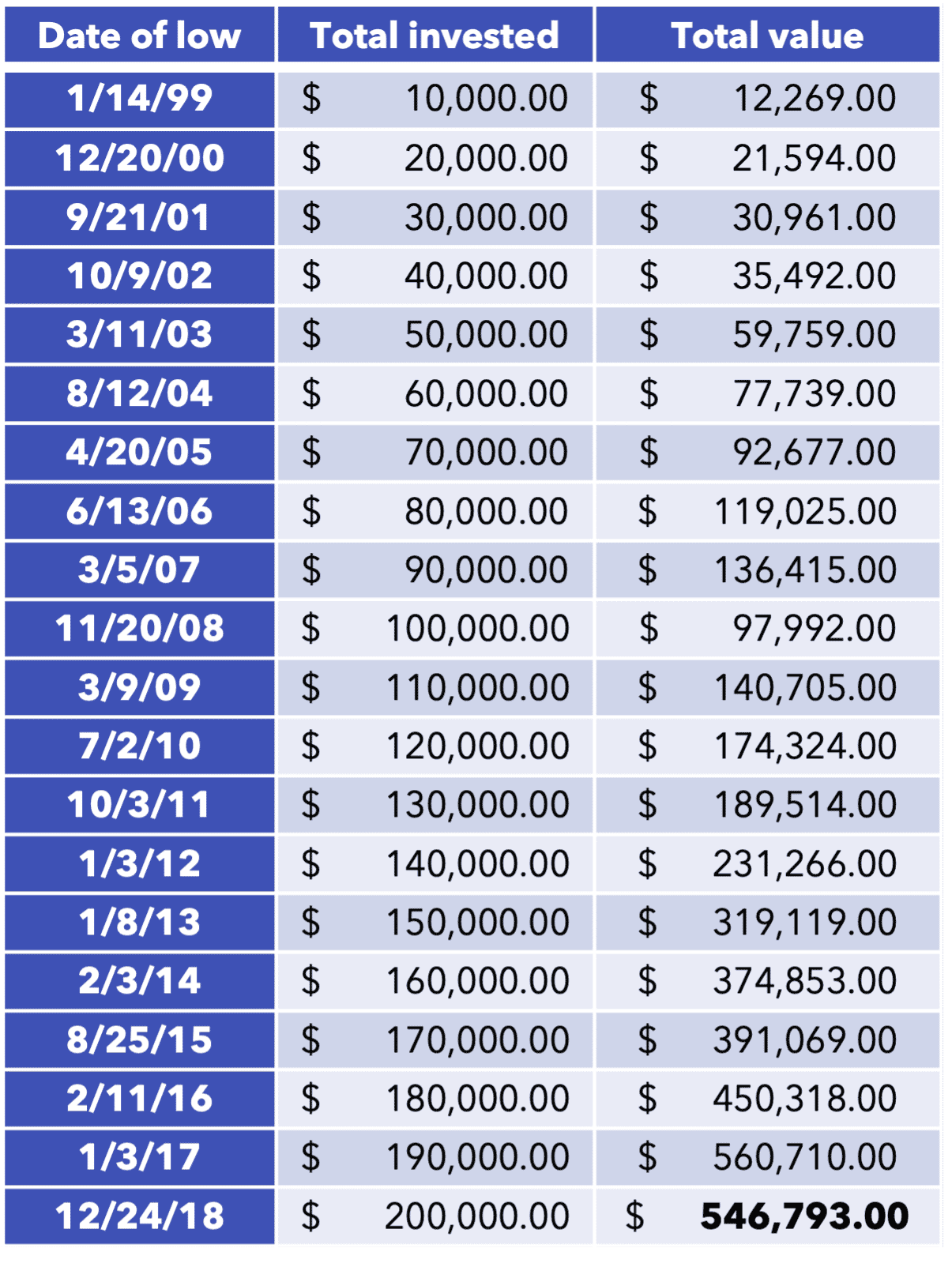

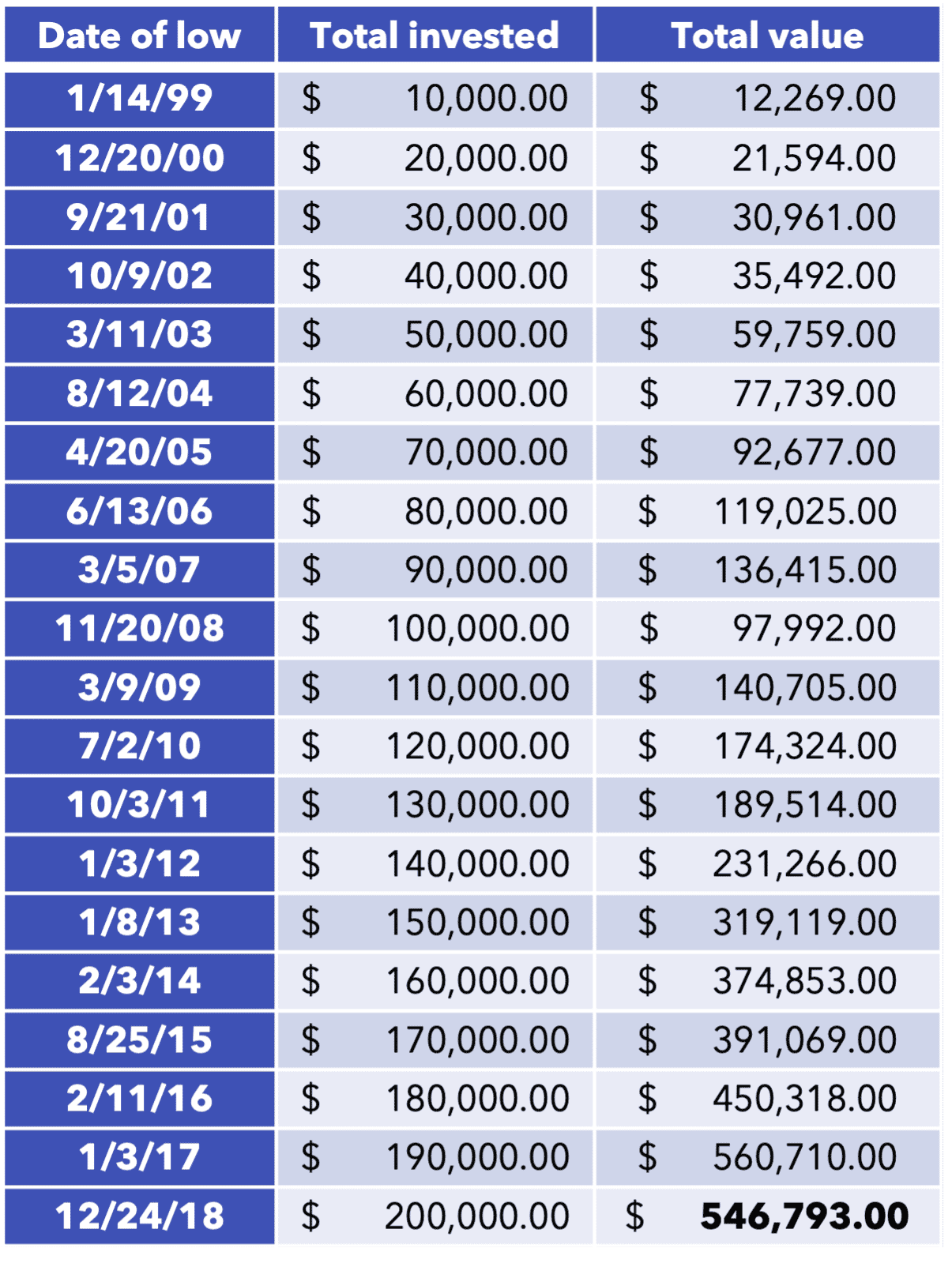

Let’s have a look at how the data looks for Jill:

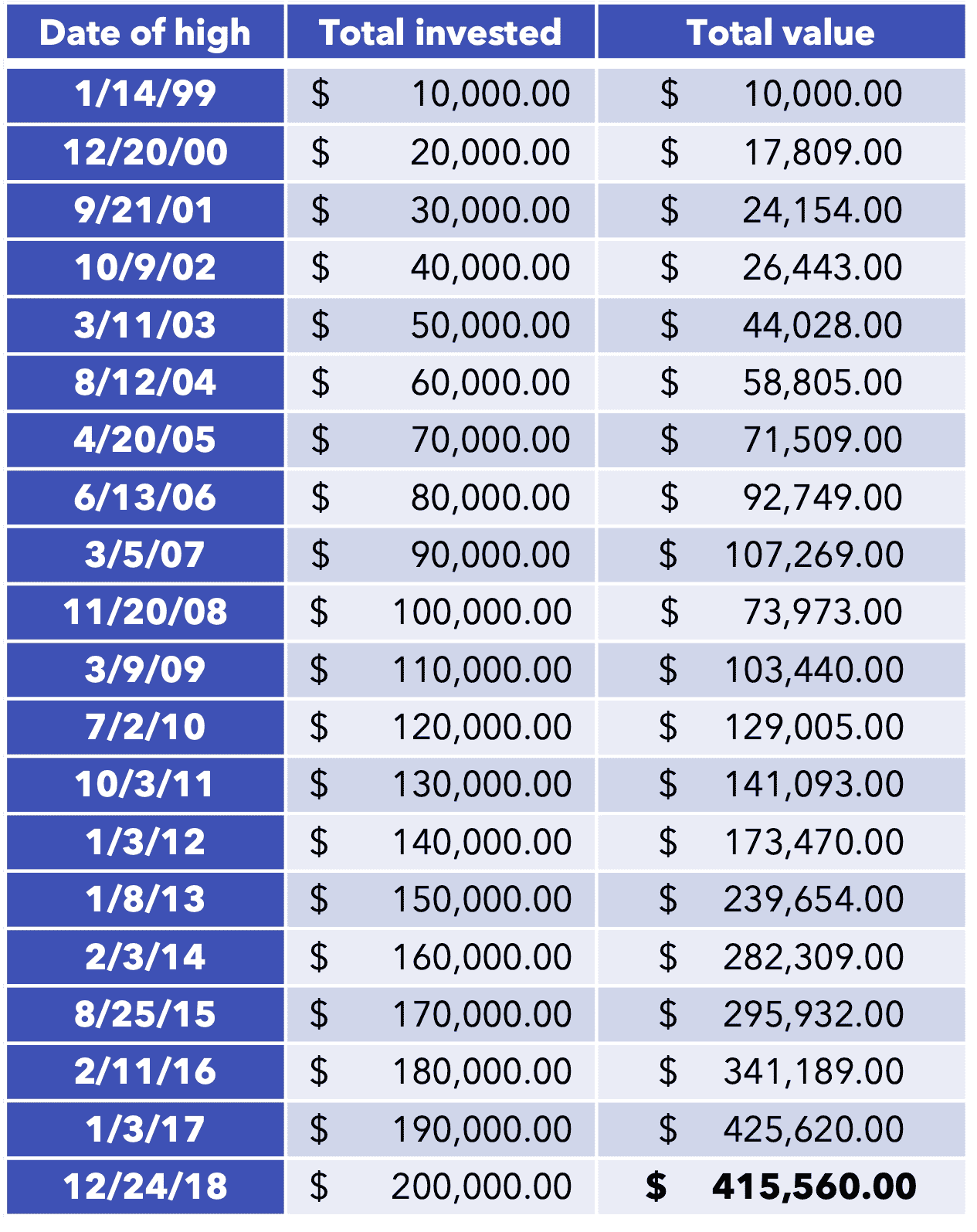

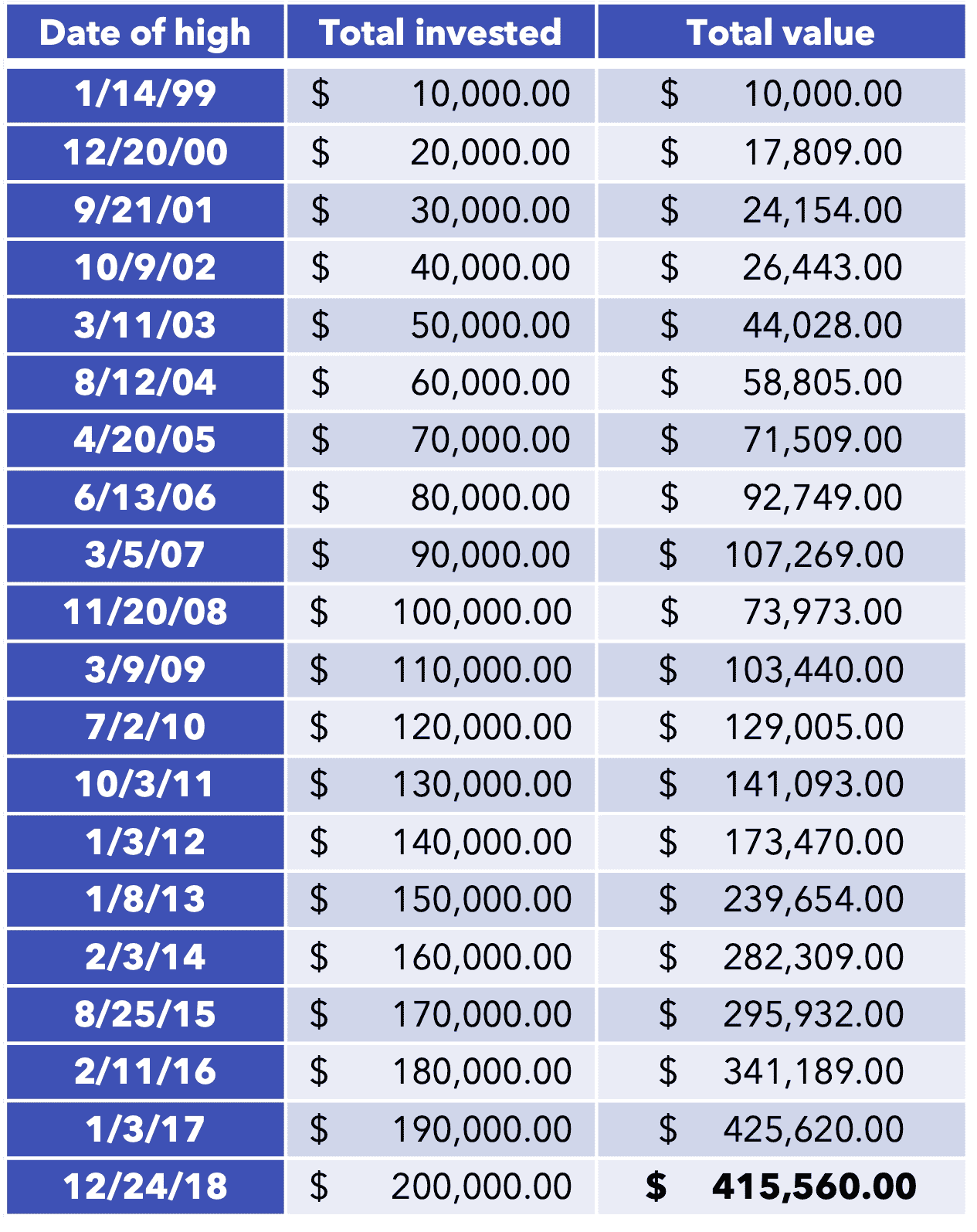

And how did the data for John compare:

How did the returns actually compare..?

In the case of Jill, by managing to pick the market low each year over a 20 year period, she achieved an annual return of 9.16%, while John, sadly picking the single worst day each year to invest, still managed to achieve an impressive 6.91% per annum.

Even though John managed to achieve a lower return than Jill, he still managed to significantly outperform the result he would have achieved by leaving his money in his bank account, which would have delivered an annual return of just 2.2% per annum.

What does all of this mean..?

The first important point you’ll note in our illustration above, was that at no point did John or Jill decide that they would pull out of the market, or hold onto the cash and wait until it felt safer before investing each year. They maintained a disciplined approach, and invested the same amount each year. History teaches us that over long enough periods of time positive investment outcomes are achieved far more often than negative ones.

In fact, over a 10 year investment holding period, a positive outcome was achieved 94 – 95% of time, compared with just 75% over a 1 year time period.

The last few years has been trying for many investors, with some stopping contributions to their account, or even worse, cashing in their investments and crystallising their losses. The most important lessons that history continues to teach us are simple:

- Stay disciplined with your regular investments, in the good times and the bad.

- Maintain an appropriate asset allocation based on your goals and risk profile, and rebalance when necessary.

- Avoid seeking advice from well-intending friends and family, and instead seek advice from a qualified professional.

- Don’t try and time the market, but rather focus on your time in the market.

If you have any questions about your investments, or want to check if your asset allocation is appropriate for your risk profile and goals, reach out to our team or leave a comment below.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances and objectives. We recommend you obtain professional financial advice specific to your circumstances.