Preparing for Your Repatriation to Australia

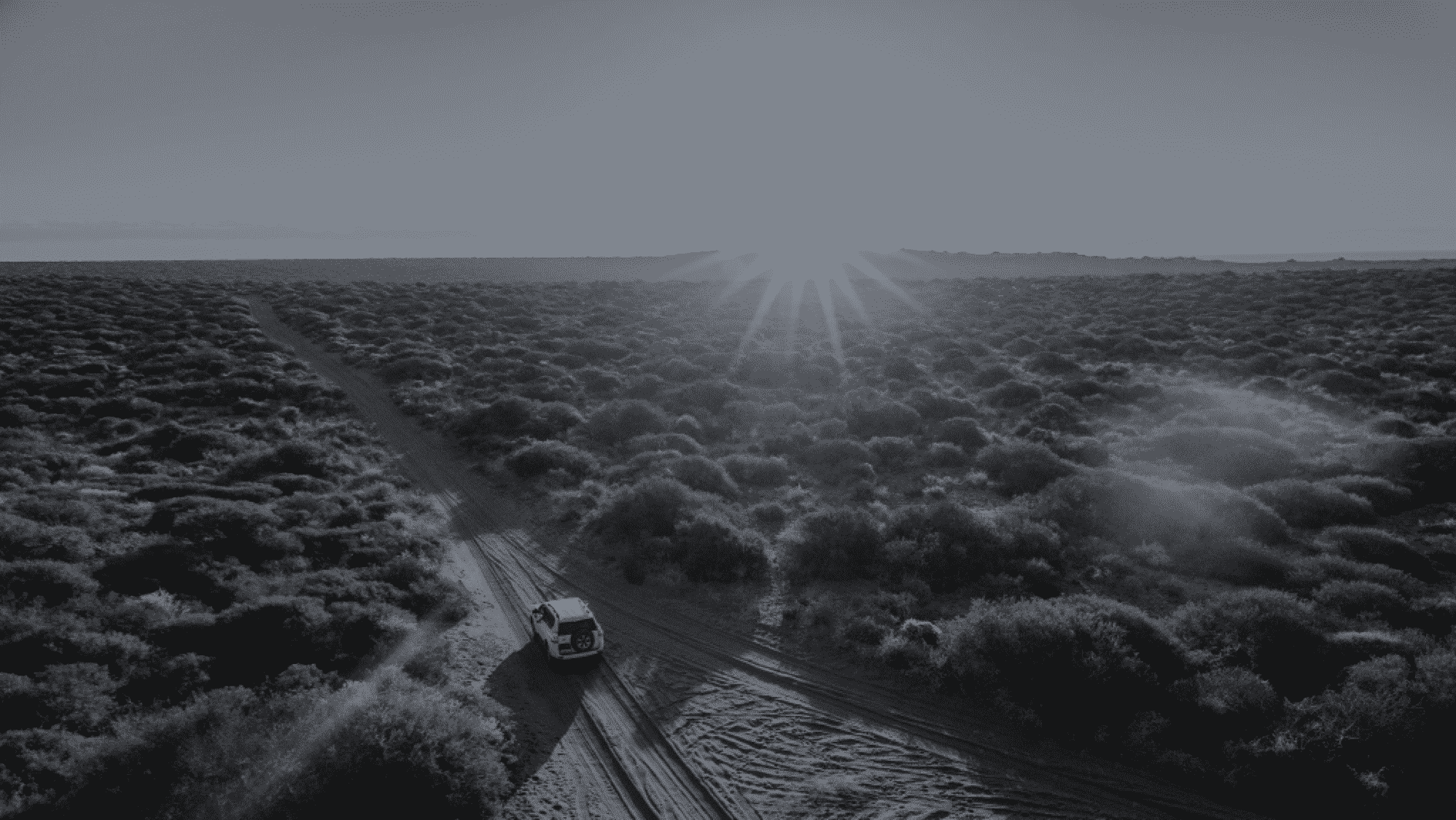

Australia is often described by many outside of the country as a ‘big, beautiful sandpit’, and it’s precisely this natural beauty, coupled with our relaxed way of life, easy-going nature, and outdoor lifestyle that make it appealing for many Australian expats to return home, whether to work or retire. Since Covid-19 started wreaking havoc on global economies, we have seen tens of thousands of Australians return home from their offshore post, and time will tell precisely how many leave Australia’s shores again.

This desire for many Australian expats to return home is commonly referred to as the ‘boomerang effect’, where we’re likely to be drawn back down-under at some point in our lives.

This is an area that our team at Ally Wealth Management is commonly working towards with our clients, both in preparation for their return to Australia, and their plans once they’re back when it comes to their personal finances. This week we’re sharing our eight top tips for planning for seamless repatriation to Australia.

- Should you rent or buy your primary residence..?

There are many considerations to factor in when it comes to deciding whether you should rent or buy your primary residence in Australia. Some of these could include:

- How long you’re planning to remain in Australia

- Do you have the deposit available to purchase where you’d like to live

- Is it more affordable to rent or buy based on the rental yield

- Do you know where you want to live for the long-term

You may also want to consider the strategy of ‘rent-vesting’, whereby you purchase an investment property and rent your primary residence. This can be quite a complex strategy when tax considerations are factored in, so it’s important to seek personal tax (financial) advice here and consider if this is suitable for you.

For many repatriating Australians, it can be a sensible idea to rent first for six to twelve months while you’re deciding where you want to live, as you may find that your tastes have changed significantly since you last lived in the country. Unless you’re completely certain on exactly where you’d like to live, or you’re moving into an existing property, this strategy may just save you some buyer’s remorse.

- How can you make the most of superannuation..?

Australia’s superannuation system is one of the largest and most developed retirement savings vehicles in the world and remains one of the most tax-efficient ways for individuals to save for their retirement. This is particularly true if you’re looking to retire in Australia given the tax benefits of your superannuation in your ‘golden years’.

If you’re repatriating to Australia, it’s important to factor in that some of your retirement savings will be covered by your employer to your superannuation fund, which in most cases can be a fund of your choosing. The contribution rate is set and is currently at 10% of your salary, which could mean a reasonable amount being contributed towards your retirement each year. It’s important to seek professional advice here and review which fund is going to be suitable for you and that your investment strategy within your superannuation fund is aligned with your risk profile and financial goals.

Finally, it’s also important to consider whether you should ‘salary sacrifice’ additional amounts into your superannuation fund, which could both reduce your tax liability and boost your retirement savings. The additional amount contributed to your superannuation can be treated as a tax deduction, which can reduce your overall tax liability. Again, ensure that you’re seeking professional advice here.

- Should you repatriate your offshore investments..?

If you’ve set up offshore investment plans and policies while you were living and working overseas, you should consider how they will be treated once you’re an Australian resident for tax purposes again. Some of these offshore plans can receive quite harsh tax treatment for those repatriating to Australia, so ensure that you do your homework upfront.

If you’re planning on retaining offshore investments, and even continuing to contribute to these plans, then you should consider any FX implications of transferring funds offshore, and ensure that your investment strategy remains appropriate for you.

- What should you do with your international health insurance..?

Many Australian expat families and individuals will either take out individual health insurance or receive cover via their employer while living and working offshore. It’s important to consider your options when you return home when it comes to your health insurance, which could be along the lines of the following:

- Can you convert your international policy to a local Australian one..?

- Should you simply cancel your offshore policy..?

- Is your international plan competitively priced and sensible to maintain in Australia..?

You should also consider how long you’re planning to remain in Australia, as if you’re looking to move abroad again in the short to medium term, then it may be a sensible option to consider simply pausing your international plan. Ensure that you consult with your insurance adviser here to explore your options.

- Is your offshore life insurance still valid in Australia..?

Many Australian expats will also take out individual or company Life, Total and Permanent Disability (TPD), and Critical Illness insurance plans while working abroad. If these were taken out individually, then it’s important to consider whether you remain covered once you’re back in Australia, what the process of making a claim would look like, and any currency risk. For example, if your insurance policy pay-out is denominated in Hong Kong Dollars (HKD), then it’s important to ensure you factor in the risk of the HKD moving against the Australian Dollar (AUD).

There are many international insurance plans that will remain valid in Australia once you’ve returned, and can even allow you to set them up in Australian Dollars (AUD) to mitigate the foreign exchange (FX) risk, but again it’s important to seek professional advice here to consider your options.

- How should you structure your investments in Australia..?

If you’ve been living and working in a low-tax environment as an Australian expat, such as Dubai or Singapore, then chances are you’ve not given a great deal of thought to realised capital gains, or how you could minimise the tax treatment of your investments while you’re living and working abroad. Once you become an Australian resident for tax purposes again, however, this becomes a critical component of your financial plan.

There are many options that you can consider and work through with your Financial Planner to find the right one for you such as:

- Discretionary Family Trust

- Company

- Unlisted Unit Trust

- Superannuation

- Joint Ownership

Each of the various options has their own costs and benefits, so it’s important to review your options in their entirety and ensure that you factor in the ongoing costs of running such a structure.

- How can you maintain your international networks..?

For those that have been working offshore, particularly if you’ve been outside of Australia for a long time, chances are you’ve built up a great network of friends and colleagues all over the world. It’s important to find ways to stay in touch with your network, whether it be through social media such as Facebook or LinkedIn, or arranging a regular video catch-up, or even joining community groups and networks to stay connected.

- How can you find like-minded people and groups in Australia..?

Finally, one of the common aspects that many of our clients and friends who’ve made the move back to Australia tell us, is just how much the conversation changes. No longer is it about career opportunities in New York or London, or how you’re jetting off for the weekend to Phi Phi Islands, but instead it becomes about who won the (insert sport depending on the state of residence) on the weekend. This can be quite a shock to many, so you may wish to plan ahead and start identifying groups of other expats who’ve returned to Australia. There are plenty of options on Facebook and other social networks so that you can ensure you’re not alone in your return home, and you can make the whole experience as seamless as possible.

If you have any questions about planning to repatriate to Australia or want to start exploring your own options and plan ahead, reach out to our team at Ally Wealth for an obligation-free discussion.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances and objectives. We recommend you obtain professional financial advice specific to your circumstances.