Life Insurance for Australian Expats

One of the most important considerations if you’re looking to become an Australian expat or you’re already living overseas is to review your personal insurances and ensure that both you and your family would be protected in the event that the unexpected was to strike. We’re not referring to basic health insurance here to cover the cost of your treatment, but rather we’re referring to Life, Total & Permanent Disability, Critical Illness or Trauma, and Income Protection Cover, to provide you and your loved ones with peace of mind when it comes to potentially financially debilitating events.

This week our team at Ally Wealth Management is exploring the key considerations of Life Insurance for Australian expats.

Let’s start with what life insurance actually is

Life insurance provides a lump-sum payment of the benefit amount to your loved ones in the unexpected event that you pass away or are diagnosed with a terminal illness. As we progress through life and take on major financial commitments such as purchasing a house, starting a family, or running your own business, it’s important to ensure that we’re protecting those that we care about from major financial burdens in the event that something happens to us.

The key questions we need to ask ourselves when it comes to life insurance are:

- Do you have a partner and/or financial dependants..?

- Are they reliant on your income for their lifestyle..?

- Are there other financial commitments that are reliant on your income..?

Why do I need to consider having life insurance?

A life insurance payout to your surviving family members can play an important role in your family’s financial plan. Some of the key aspects to be covered by your life insurance include:

- Avoid Forced Property Sales: Funds to clear outstanding mortgages and home loans.

- An Income to Maintain Their Lifestyle: It’s always a sensible idea to ensure that you have at least 2 – 4 years’ worth of living expenses covered for your surviving family members.

- Pay For Your Funeral: Ensuring sufficient funds to pay for your funeral.

- Repatriate Your Family: Funds to cover your family’s return home to Australia or elsewhere.

- Education Costs: Funds to cover your children’s remaining education costs.

But won’t my Australian insurance cover me while I’m offshore..?

The easiest way to check if your insurance cover is valid is to speak to a qualified Australian financial planner, and have them review this for you. They will analyse the Product Disclosure Statement (PDS) and supporting documentation, and speak directly to your insurance fund about your cover to confirm it’s validity for overseas residents, and what the relevant terms and conditions are for you as a non-resident of Australia.

If you find out that your Australian insurance cover isn’t valid while you’re living overseas, it’s important to explore your options. You may wish to implement insurance cover in your current country of residence, that will remain valid for you when you return to Australia. If you wish to hold your insurances inside your superannuation fund, it’s important to review your options with your qualified Australian financial planner to identify an Australian provider that will cover you overseas. You also need to ensure that you’re fully aware of how long the cover will remain valid if you find that your overseas position is extended beyond.

Isn’t my employer-provided life insurance good enough..?

Most employer-provided life insurance cover is for 2 – 3 times your annual salary. Very rarely is this sufficient cover for most Australians. It’s also important to keep in mind that should you change employers, your new employer may not provide you with any cover, and implementing new insurance at a later age could be substantially more expensive, and if you have any pre-existing conditions at that stage may not be a possibility at all. It’s important to review how you can factor in your employer cover when exploring your insurance needs.

Is life insurance really that important..?

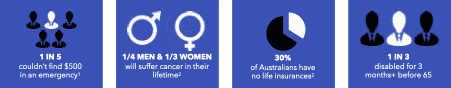

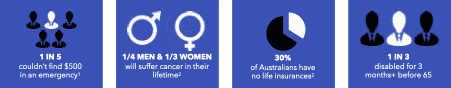

Unfortunately, for many Australians, the value of an appropriate life insurance policy is only realised when it’s too late. With over 95% of Australians failing to have adequate life insurance in place, the statistics are alarming. Outlined below are some of the key relevant statistics highlighting just how important the right life insurance policy can be for you and your loved ones:

As always, it’s important to seek the guidance and advice of an experienced Australian financial planner who can explore your options and ensure that you have the right insurances based on your personal circumstances.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances and objectives. We recommend you obtain professional financial advice specific to your circumstances.