Deemed Disposal of Shares for Australian Expats

If you’re currently living and working in Australia and are considering a placement offshore, or if you’re currently an Australian expat, then it’s important to consider what happens to your shares and other assets when you depart and repatriate to Australia.

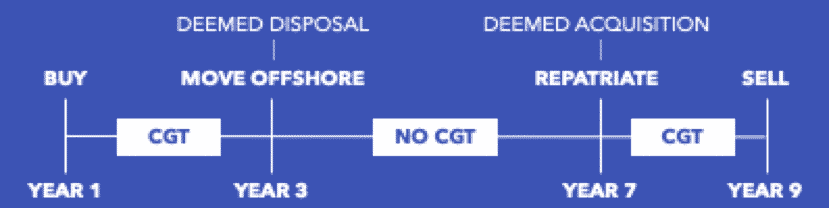

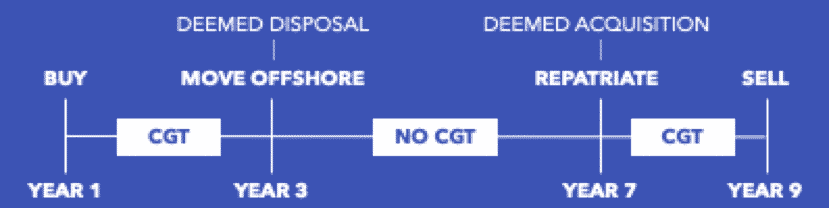

This is what is referred to as the Deemed Acquisition and Deemed Disposal rules. As an Australian expat, when you cease being an Australian resident for tax purposes, you are ’deemed to have disposed of your assets, which are not considered to be Taxable Australian Property (TARP assets) at the market value at the date of your departure. It is at this point that a Capital Gains Tax (CGT) event takes place, and tax is either paid on the capital gain realised or a tax loss is created if the shares or other investments have decreased in value.

Following this deemed disposal, these assets are no longer subject to Australian CGT while you are a non-resident of Australia for tax purposes. This can be particularly attractive for those relocating or residing already in tax-friendly jurisdictions such as Singapore.

Outlined below is a simple example of how this could work:

While it is not a requirement that you complete a Deemed Disposal at your point of departure, it’s an important consideration. Unfortunately, you can’t select which shares you carry out a deemed disposal on and elect not to do so for others. This means that it’s important to do your homework to decide whether you should action a deemed disposal or whether you should decide to defer the CGT event into the future. This means seeking professional tax (financial) advice to explore your options and crunch your numbers.

A Deemed Disposal can be carried out for Non-Taxable Australian Property (TARP) assets including; Shares, Exchange Traded Funds (ETFs), Managed Funds, Hedge Funds, Unit Trusts. It is important to note that this is not restricted to domestic Australian shares and funds but can apply to global investments.

Contrary to popular belief, there is no specific Capital Gains Tax (CGT) rate, and any capital gain is simply added to your taxable income, and your marginal rate of tax applies. This could therefore be upwards of 47% excluding the Medicare Levy. If you have held the shares or other investments for a period greater than 12 months while a resident of Australia, you may be entitled to a 50% discount on the capital gain for tax purposes, so it’s important to check on the holding period.

Prior to the 8th May 2012, non-residents of Australia were also entitled to the 50% discount on capital gains for assets held for more than12 months, however, this was restricted to include Australian tax residents only.

If you’re already living offshore and haven’t completed a Deemed Disposal, you need not worry. In most cases, you can complete this retrospectively as an adjustment or amendment to a previous tax return. If you didn’t submit a final tax return upon departure, then we would suggest speaking with your accountant to ensure that this is actioned for you.

It’s important to speak with a qualified financial professional experienced in working with Australian expats such as yourself. You may find that based on your financial situation and goals that deferring the capital gain and not completing a deemed disposal is the most sensible option, so it is important to seek professional advice.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances, and objectives. We recommend you obtain professional financial advice specific to your circumstances.