Australian Expats Guide to HECS – HELP Debt

The HECS-HELP system is a scheme that allows the Australian Government to assist students with their tuition fees by providing them with a loan. They are available at most public universities and a select group of private institutions also.

Prior to the 1st July 2017, Australian expats could study at a local university with a student loan, and if they went to work overseas they wouldn’t have to repay it. However, this all came to an end on 1st July 2017. From this date, if you’re an Australian expat with a Higher Education Loan Program (HELP), VET Support Loan (VSL), or Trade Support Loan (TSL), you are required to declare your worldwide income to the Australian Tax Office (ATO) and make the required loan repayments.

It is important to note that if you’re an Australian expat and don’t have a HECS, HELP, VSL, or TSL loan, then you don’t need to declare your worldwide income to the ATO. If you do have a student loan, it’s important that you keep your contact details current via your MyGov account, which we’ve outlined below. This has been required for all Australian expats from 1st January 2016.

What do you need to do?

There are two key methods to reporting your worldwide income to the ATO, which must be declared between 1st July and 31st October each year unless there is a particular exemption granted or these timelines are changed. We’d suggest checking online via your MyGov account or with your accountant or tax adviser.

- MyGov Account

If you already have your MyGov account set up, you can log in and declare your worldwide income via the website. If you’re having trouble with the 2FA (Two Factor Authentication), be sure to turn this off and download the myGov Code Generator app to log in.

- Accountant

Your accountant can also lodge your worldwide income for you if you would prefer to use this method, and they can ensure that the correct disclosures are made for you.

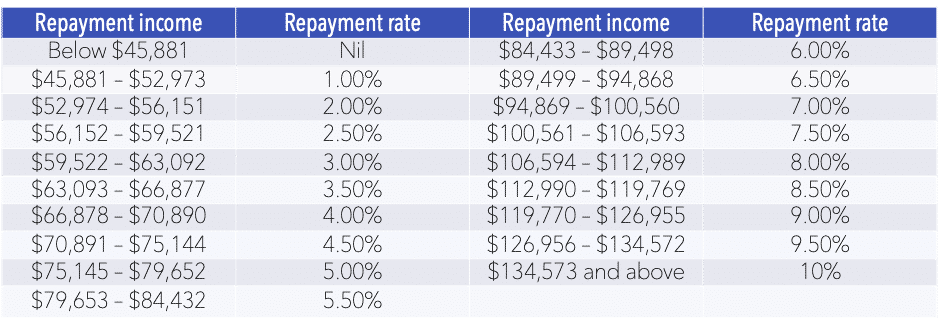

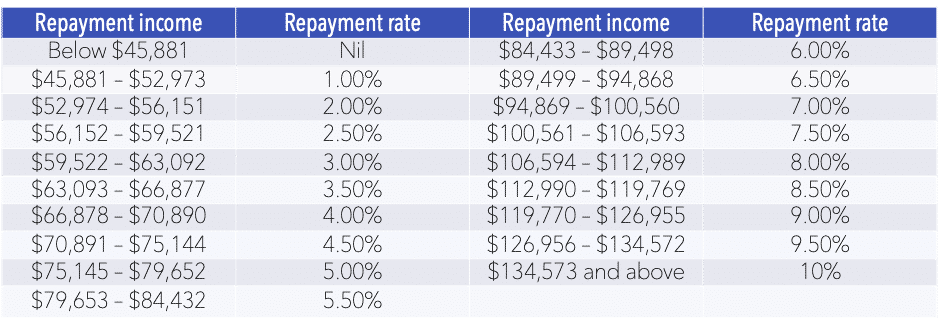

How much do you need to repay?

At the time of writing, the minimum repayment amounts are outlined in the table below, however, we would recommend checking these to ensure that you’re aware of the current obligations.

How do you calculate your worldwide income?

There are three methods to calculating your worldwide income for a declaration to the ATO:

Simple Assessment Method

This option requires you to declare the gross amount of foreign income and your occupation. A deduction will then take place based on your occupation to determine the overseas levy.

Overseas Assessed Method

This option allows you to enter the foreign income you were assessed on from your most recent tax assessment. The assessment is required to cover a 12 month period, even if the income wasn’t earned for the entire 12 months. You are not able to use this method if:

- You didn’t receive a tax assessment from the foreign tax body;

- The tax assessment doesn’t cover 12 months and overlaps 1st July – 30th June;

- You have multiple assessments from different countries;

- You have previously used this particular assessment to calculate foreign income.

Comprehensive Tax-Based Assessment Method

This option allows you to declare your gross foreign income, and include allowable deductions in your country of residence.

What if you earn less than the threshold?

If you earn less than the $12,989 figure, being 25% of the minimum repayment threshold, you must still lodge non-lodgement advice with the ATO. If you earn between this and the minimum repayment threshold, you must still report your worldwide income to the ATO, however, the overseas levy will not be applied.

If you’re not sure whether you have a HECS-HELP, or other student loans, to be repaid, or you’re not sure whether you should repay extra or invest this money, feel free to reach out to our team at Ally Wealth Management to explore your options.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances, and objectives. We recommend you obtain professional financial advice specific to your circumstances.