Australian Budget 2022 – The GOOD, The BAD & The UGLY

On Tuesday 25th October the Labor Party handed down their ‘mini-Budget’ for 2022-23 under the theme of ‘responsible, not reckless’, with reference to the fact that ‘Australians know that there are hard days to come’.

There was not a great deal of surprise in this year’s Budget, with limited relief provided to families feeling the pinch of higher inflation levels, low levels of wage support across multiple sectors, and relatively little support to increase the much-needed supply of affordable housing across the country given the rental pressures we’re already seeing, which will only increase as our immigration increases.

Here we explore the GOOD, the BAD, and the UGLY of this year’s Budget for you to digest.

The Good

- Enhanced Paid Parental Leave

- Households with a combined income of below $350,000 will receive 26 weeks of paid parental leave from 2026.

- Improved Childcare Subsidies

- The maximum subsidy will be increased to 90% for families for the first child in childcare providing household income is below $530,000.

- Cheaper Medicines

- The maximum co-payment for scripts on the PBS will be reduced from $42.50 to $30.

- Tax Cuts to Remain

- The proposed tax cuts for those earning between $45,000 – $200,000 are set to remain, at least for now.

- This means that anyone earning between $45,000 and $200,000, they will not pay any more than 30% tax.

- Aged Care Staffing

- Over $2.5bn is set aside over the next 4 years to address the royal commission concerns raised and encourage staff back into the sector.

- Downsizers

- The minimum age to downsize your home and contribute up to $300,000 into your super fund will be reduced from 60 to 55.

- This contribution does not form part of your non-concessional contribution.

- Students

- Fee-free TAFE and University places will be created to further educate students across the country, with more grants and support offered to those in lower socio-economic areas.

The Bad

- Crypto Traders

- Bitcoin is set to be officially enshrined in tax law and Capital Gains Tax (CGT) will apply upon sale.

- The 50% discount will also apply, and the tax will also apply where crypto is traded for other digital currencies.

- Government-backed digital currency however would be taxed as a foreign currency.

- Renters

- The new Housing Accord is committed to encourage the development of 1 million new homes over the next decade, which given the private sector built approximately this many over the last decade does not suggest it will ease a great deal of the rental pressures.

- Further, the Government will provide $350m for an additional 10,000 affordable homes, which is a positive, but a small step to addressing the rental pressures given the immigration figures for the country.

- No support payments or temporary relief was announced to ease the pain of the currently high rental prices.

- Motorists

- The fuel excise discount is not going to be extended, which came as no surprise, despite the high costs of petrol.

- Depreciation of Intangibles not to be Self-Assessed

- In the 2021-22 Budget, it was announced that tax-payers could self-assess the effective life of an intangible depreciating asset.

- This has been scrapped and depreciable lives will be set by statute.

- No Updates on Tax Residency for Expats

- Unfortunately, there was no discussion or mention of the proposed changes to the tax residency rules.

The Ugly

- Parents of Older Children

- While it’s pleasing to see childcare subsidies and paid parental leave improvements, there is no provision for the increased cost of living for those parents with older children.

- Diversification of the Economy

- There was some discussion on medical manufacturing, renewable energy, and infrastructure projects with $15bn being allocated, however little to incentivise multi-nationals to expand into Australia.

- Inflation to Remain High

- The current Government expects that inflation will remain relatively high for the next 3 years.

- The inflation forecast is outlined in the chart below:

Source: Treasury, MWM Research, October 2022

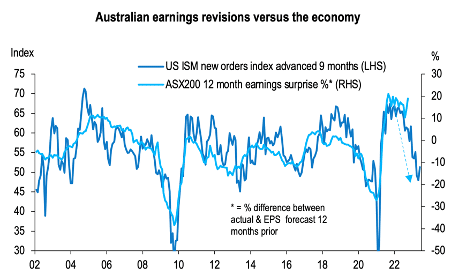

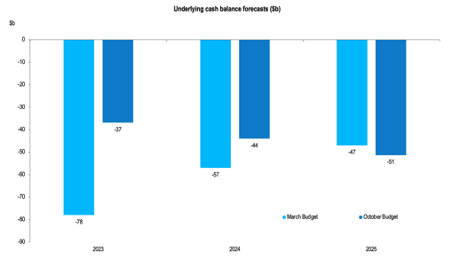

Overall, this is a Budget designed with conservative commodity price forecasts, particularly for coal and iron ore, and is designed to retain some of the increased revenues, as can be seen in the following chart:

Source: Treasury, MWM Research, October 2022

In terms of the impact of this Budget on capital markets, we see little impact on equity prices or the risk premium that is applied and are unlikely to impact any of the current trends. We may see some upside for developers, construction material providers, and various fitting supply operators. In regard to the fact that this Budget delivers a lower deficit, this is unlikely to put any pressure on the independent RBA to increase rates further than currently expected.

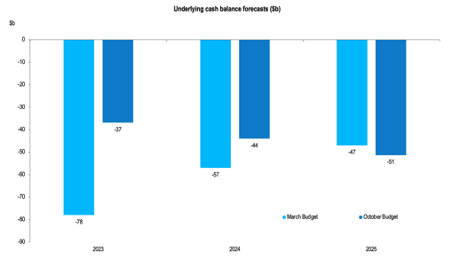

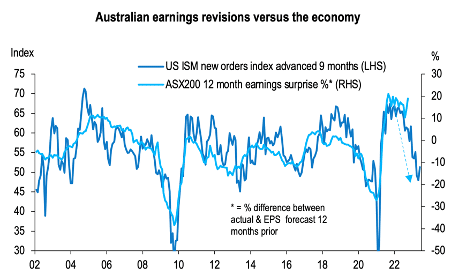

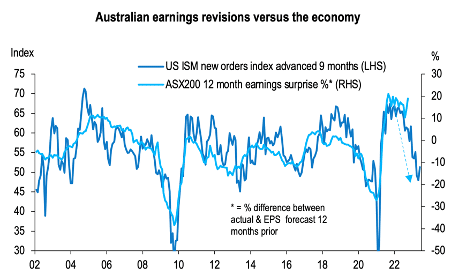

In terms of corporate earnings across the Australian market relative to the rest of the world, earnings surprises remain relatively strong, which can be seen in the diagram below:

Source: FactSet, MWM Research, October 2022

Overall, this is a Budget with little surprise, and we were disappointed not to see any discussion or clarity provided regarding the proposed tax residency changes. We don’t see any need to adjust portfolio positions based on this Budget and will be monitoring markets for opportunities.

If you have any questions at all about how the Budget may impact you or your business, please reach out to us.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances and objectives. We recommend you obtain professional financial advice specific to your circumstances.