Australian Budget 2020 Wrap-Up

The Australian Federal Budget for 2020 was one of the most widely anticipated Budgets in recent history, particularly given these unprecedented times that we are all going through. It was clear that it would be a Budget focused on spending, jobs creation and getting Australia through this period.

This week our team at Ally explores the key announcements in the Australian Federal Budget, the winners, the losers and those that were ignored, as well as what opportunities may be created in the markets as a result.

Let’s start with the key highlights of the Federal Budget

The Federal Budget Deficit was announced as $213.7 billion, with a net debt position currently of $703 billion, which represents 36% of Australia’s GDP. This is forecast to spike to $966 billion by 2024, which represents a whopping 44% of our GDP. While this is certainly a high number, and will take some time to be reduced, it’s important to recognise that it’s not dissimilar to many other nations and certainly isn’t the highest.

The new COVID-related spending announced in the Budget came to a total of $111 billion, for the Real GDP for 2020-21 is expected at -1.5%, with an expectation of a bounce of +4.75% throughout 2021-22.

What are the key sectors to receive a boost?

There were a number of focus areas, which we’ve highlighted below:

- Tax Relief: The previously announced tax cuts were brought forward, which are expected to benefit approximately 7 million Australians. We also saw the announcement of businesses being able to carry backward tax losses to offset previous gains, and the instant asset write off allowances for Australian businesses also.

- Job Creation: This was a key focus area of the Federal Budget, with the JobMaker program announced, expected to create 450,000 jobs for 16 – 35 year olds, JobTrainer, which is a $1 billion training program and a $1.2 billion wage subsidy for 100,000 apprenticeships across the country.

- Research and Development: This is often a focal area, and this Budget was no different. We saw $2 billion announced for R&D incentives via CSIRO and Universities, and a Climate Change fund to receive $1.9 billion to support renewable technologies.

- Infrastructure: $14 billion was announced to accelerate new projects and create new jobs quickly, with $2 billion committed to road safety upgrades and a further $2 billion to water infrastructure.

- Environment: National Parks is to receive $233 million, ocean protection a further $67 million and recycling infrastructure an additional $250 million.

- Healthcare: An additional 23,000 home care packages will be created with the aim of allowing older Australians to remain in their own home for longer totalling $1.6 billion, as well as the NDIS receiving a further $3.9 billion.

- Cybersecurity: Clearly a focus area globally amongst Governments, and this year’s Budget certainly explored this area with $1.7 billion committed to supporting development in this space.

- Superannuation: While we didn’t see any major reform, changes to contribution allowances or otherwise, we did see some small tweaks. Superannuation funds will be tied to the individual with the aim of avoiding duplicate super funds, which will likely be of greatest benefit to younger employees who tend to changes employers frequently and end up with many super funds. We will also see the benchmarking of MySuper products by APRA and the launch of a YourSuper comparison tool for the MySuper products.

What is the Australian economic outlook for 2021 and beyond?

In addition to the Budget announcements themselves, it’s important to explore what the forecasts look like for the Australian economy. We have outlined the key aspects below:

– GDP forecast for 2021: +4.25%

– Wage growth for 2021: 1.5%

– Net migration for 2021: -72,000

– Net migration for 2023: +201,000

– Inflation forecast for 2021-22: +1.5%

Treasury is also forecasting an iron ore price of US$55, which is significantly below the current price. This brings us to question what could happen to the iron price if China decides to stop importing for a period of time, or when South American supply starts to increase and come back online.

There are many question marks associated with the assumptions used in creating the economic outlook, which should come as no surprise to most given these unprecedented times. Some of these include when a vaccine is found, how long it takes to distribute the vaccine on mass, how successful the international student trials are, when travel bubbles start to form, Covid case numbers during the northern hemisphere’s winter and state border restrictions within Australia, to name but a few.

Let’s explore the key changes for Australian residents

The two key announcements in this year’s Budget were really the personal income tax cuts, and the instant asset write-off relief measures, both of which we’ll outline in more detail below. Let’s explore the key announcements impacting Australian residents below:

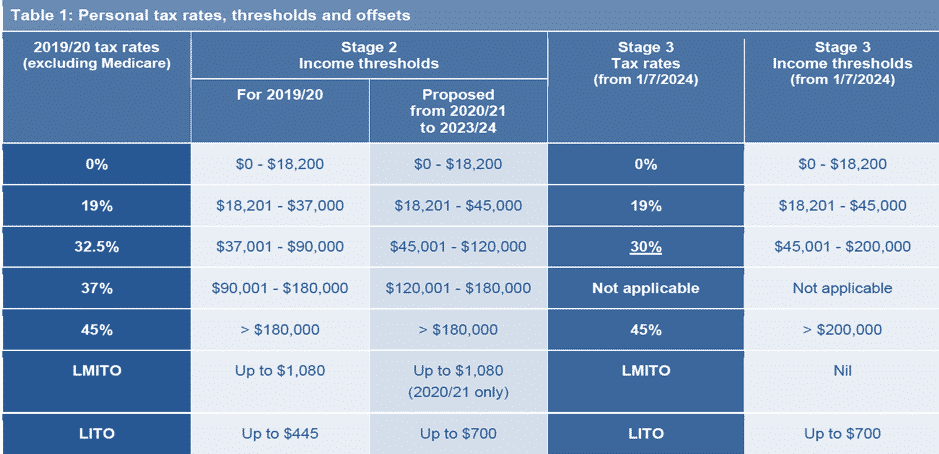

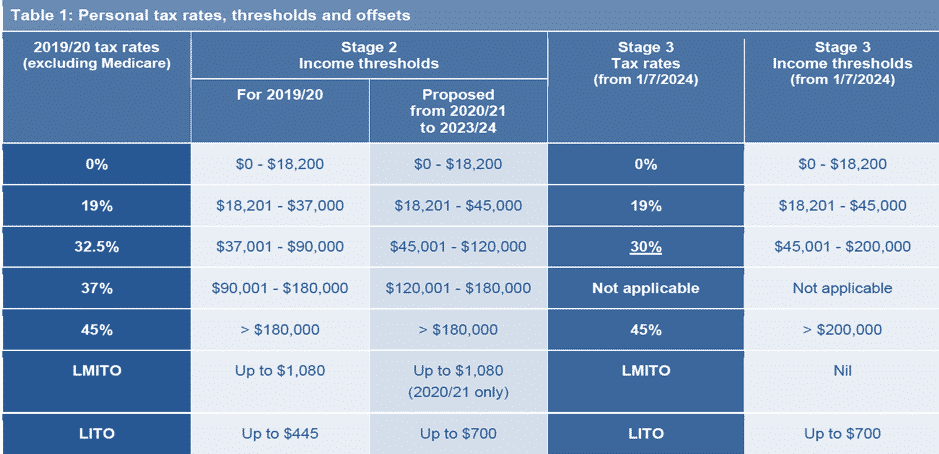

- Personal Income Tax Cuts: The key announcement here is that personal income tax cuts that were originally scheduled for 1 July 2022, are now brought forward as per the table below. These tax rate thresholds will be as follows:

- Economic Support Payments: Pension and support payment recipients are scheduled to receive two payments of $250, the first of which is scheduled for November 2020, and the second early in 2021.

- Granny Flats Removed from CGT: CGT will no longer apply where there’s a family arrangement or there are personal ties where a granny flat arrangement has been created. This is quite a complex area, so we would certainly suggest seeking professional financial advice here.

- First Home Loan Deposit Scheme: We have seen a further 10,000 places released for the First Home Loan Deposit Scheme, which allows first-home buyers to enter the property market in their first home with just a 5% deposit.

For Australian businesses, there were a few key announcements also:

- JobMaker: In keeping with the theme of 2020, we have yet another job program. This one will see a $200 / week subsidy for those new employees between 16 – 29 years of age, and $100 per week for those 30 – 35. Importantly, this will be based on head count, so existing employees can not be terminated and re-hired.

- Capital Asset Deductions: This was a more significant announcement, which now allows businesses to fully expense their new depreciable assets in the first year of use, rather than over their depreciable lives. This also applies in some circumstances to second hand assets.

- Carry Back Losses: Further, Australian companies can now also carry back losses from financial years 2019-20, 2020-21 and 2021-22 to 2018-19, 2019-20 and 2020-21. This is actually just a re-introduction of Gillard’s rules, which barely saw the light of day, but a positive for Australian companies nonetheless.

Let’s explore the key updates for Australian expats

There were very few announcements in the Australian Federal Budget that will impact Australian expats, as may not come as any surprise. These we’ve outlined below:

- Corporate Tax Residency: There has been clarity provided over when an Australian company would be treated as an Australian tax resident, as there has been some confusion here in the past, which could impact Australian expats overseas with companies registered in Australia.

Unfortunately, there were no updates regarding borders re-opening, or changes to the Main Residence exemption.

What are the key market opportunities?

Overall, the Budget has been relatively positive for the Australian stock market, as has been evidenced by the reaction to date. The key sectors that we are paying close attention to at present are as follows:

– Australian banking and financial services sector

– Sustainability / ESG mandated investments

– Cybersecurity

– Digital payments / eCommerce

If you have any questions at all about how the Budget could impact you, or would like to explore the various opportunities, please feel free to get in touch.

A plan is only effective if you act on it.

Ally Wealth Management is the trusted ally in finance for Australians at home and across the globe. As both Australian expats and residents, the founders of Ally have a unique understanding of the common personal financial challenges faced.

Book your complimentary appointment with our team at Ally Wealth Management to discuss how we can help you to achieve your financial goals.

Ally Wealth Management Pty Ltd is a Corporate Authorised Representative of Sentry Advice Pty Ltd ABN 77 103 642 888. Sentry Advice holds an Australian Financial Services Licence (AFSL) No. 227 748.

General Advice Warning: The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances and objectives. We recommend you obtain professional financial advice specific to your circumstances.